Introduction: The Last Luxury Frontier

Sumba hospitality investment is emerging as Indonesia’s most exciting opportunity in 2025. Unlike Bali’s crowded mass tourism, Sumba remains authentic, culturally rich, and carefully positioned for low-volume, high-yield growth.

This strategy not only protects local heritage but also attracts high-spending guests. Moreover, with fewer than 150,000 annual visitors, Sumba still offers the rarity factor investors crave.

Evidence of premium demand is already clear. At NIHI Sumba, nightly rates exceed US$2,000 while global rankings place it among the world’s best resorts. As a result, the island combines scarcity with profitability — a powerful investment equation.

1. Macro Tailwinds: Drivers of Sumba Hospitality Investment

Indonesia’s national tourism strategy is evolving. With Bali approaching saturation, policymakers are actively steering development to new destinations. The plan is also aligned with the WTTC Global Framework, which emphasizes diversification and sustainability.

Sumba is a core part of this strategy. In fact, three key forces make it stand out:

- Sumba Iconic Island (SII): The government aims for 100% renewable energy by 2035. Already, more than 40 villages operate on solar or hybrid systems.

- Cultural depth: Marapu beliefs, stone megaliths, and ikat weaving give the island a cultural richness that mass-market Bali cannot replicate.

- Tourism baseline: With fewer than 150,000 arrivals, even small growth creates exponential value compared to Bali (6M+) or Lombok (~2M).

👉 For a case study in how secondary islands evolve, see our Lombok & Mandalika 6-Pillar Strategy.

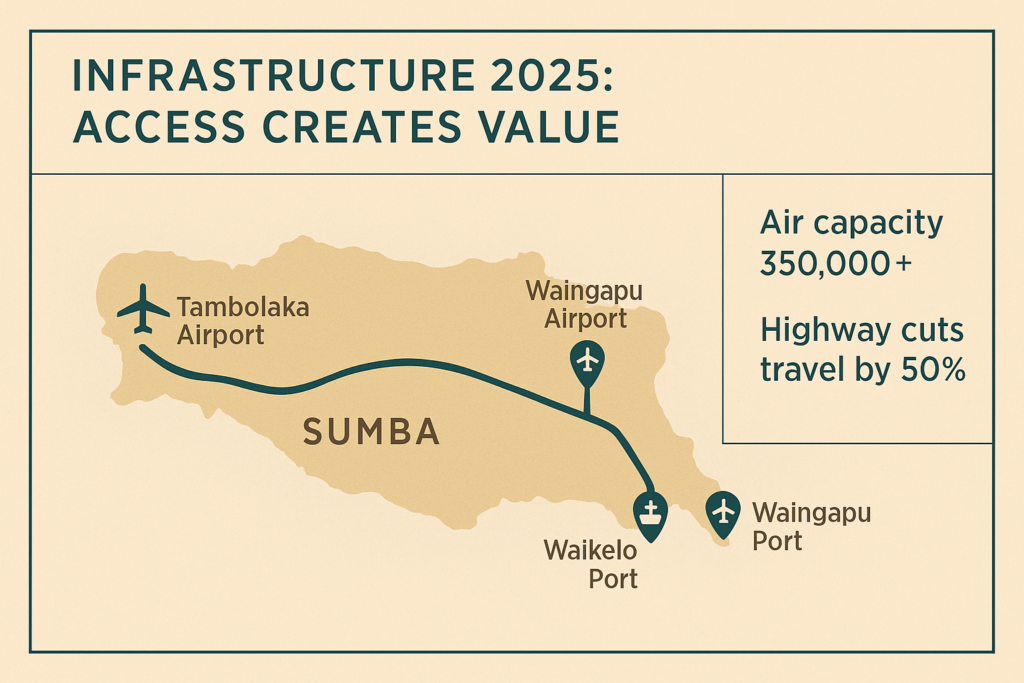

2. Infrastructure Catalysts (2025–2030)

Infrastructure is the bridge between vision and value. In Sumba, 2025 is the critical turning point.

- Airports: Tambolaka and Waingapu are increasing capacity from ~90,000 passengers to 350,000+ annually. This expansion allows larger aircraft and more frequent routes.

- Trans-Sumba Highway: Travel time across the island will shrink from over eight hours to under four. As a result, logistics become easier and guest experiences improve.

- Ports: Waikelo and Waingapu are being upgraded to manage rising cargo and visitor traffic.

- Utilities: Energy reliability is improving through renewables. However, water scarcity and waste remain challenges. Therefore, investors must budget for deep wells, desalination, and advanced waste treatment.

👉 Bali’s global rise began with Ngurah Rai’s runway expansion. Similarly, Sumba is now at a pre-boom stage — access is ready, but luxury supply is scarce.

3. The Market Reality Today

Sumba is not for mass tourism; it is a luxury niche destination.

Target segments include:

- Luxury Chasers: UHNWI travelers seeking privacy and story-rich environments.

- Wellness Fans: Guests looking for healing, retreats, and eco-conscious escapes.

Proof of demand exists. NIHI Sumba demonstrates that the market pays for exclusivity, with ADRs above US$2,000. Furthermore, the island’s natural and cultural USP — from Lapopu Waterfall to Kodi beaches — provides unmatched differentiation.

As noted in our article on The Future of Luxury Hospitality in Bali, luxury travelers are shifting toward authenticity, sustainability, and immersion. Sumba delivers all three, combined with built-in scarcity.

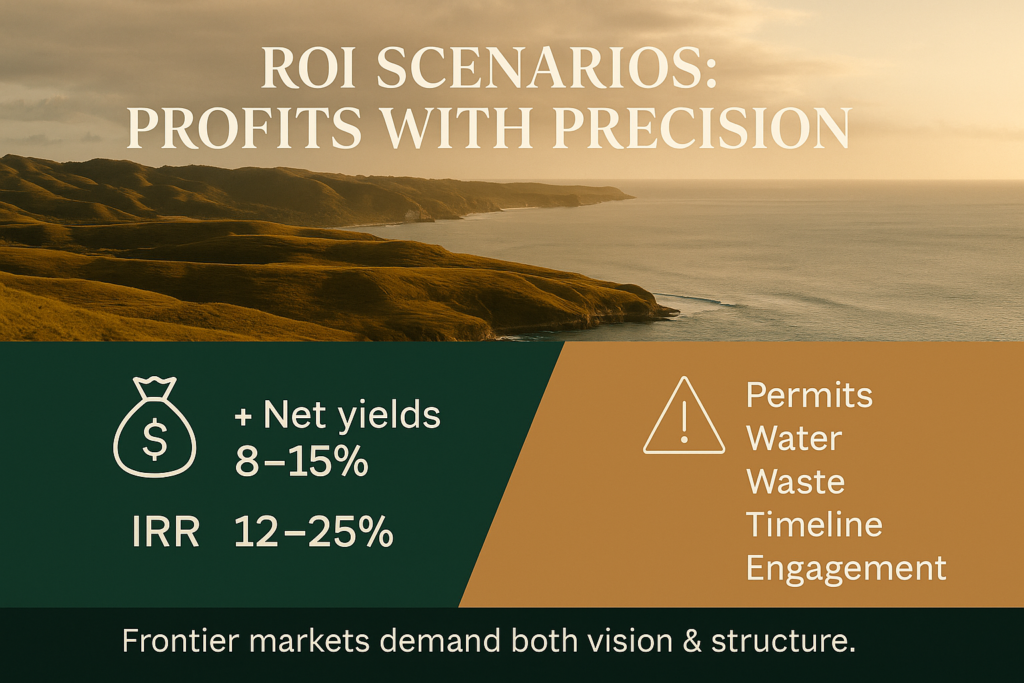

4. ROI Scenarios for Sumba Hospitality Investment

The fundamentals of Sumba hospitality investment are clear. Both hold and exit strategies can deliver strong performance.

Build-to-Hold

- Net rental yields: 8–15%

- IRR: 12–18%

- Drivers: high ADRs, limited competition, growing demand

Build-to-Sell

- IRR: 18–25%

- Supported by land appreciation (coastal plots showing ~38% YoY growth)

- Villas and eco-lodges trade as trophy assets

Scenarios

- Base Case: Arrivals double by 2025 with airport upgrades.

- Optimistic Case: Direct international flights (likely post-2027) accelerate growth curves.

Therefore, investors should run stress-tests on ADR, occupancy, and construction costs. Monte Carlo modeling is recommended to define downside exposure.

5. Risks & Realities

Every frontier market comes with risks. In Sumba, these include:

- Licensing: Investors must establish a PT PMA company, secure HGB land rights (up to 80 years), and navigate OSS-RBA permits (TDUP, PBG, SLF, AMDAL).

- Water & Waste: Reliable supply and disposal require internal solutions.

- Timeline risk: Delays in airport commissioning could push back demand curves.

- Local engagement: Collaboration with regency authorities and adat landowners is vital.

We discussed similar challenges in Overcrowding in Bali Tourism: WTTC Action Plan. In that case, short-term profit often outweighed sustainability — a mistake Sumba must avoid.

6. ESG as Competitive Edge

In Sumba, sustainability is not optional — it is the core advantage.

- SII 2035 target: A roadmap to 100% renewables strengthens both brand and operations.

- Global standards: Alignment with CSRD and IFRS sustainability frameworks makes projects bankable.

- Capital advantage: ESG-credible assets gain access to cheaper financing and higher valuations.

In fact, ESG is both a risk hedge and a revenue driver. Therefore, it should be built into every project phase.

7. Strategic Playbook for Investors

At Zenith Hospitality Global, we recommend a phased approach:

Land Banking

- Secure prime coastal or wellness-rich inland sites under PT PMA + HGB.

Concept & Permits

- Obtain OSS-RBA licenses early.

- Integrate ESG into design and engineering from the start.

Build & Operate

- Align timelines with airport and highway completion.

- Train local staff early; workforce capacity must grow with the project.

Launch & Market

- Prioritize ADR growth instead of chasing volume.

- Position as frontier luxury, not a Bali replica.

8. Conclusion: The Future of Sumba Hospitality Investment

Sumba is not Bali. Nor is it Lombok. Instead, it is Indonesia’s last authentic luxury frontier.

Infrastructure is arriving. Demand is proven. ESG is a competitive moat. What remains is execution by visionary investors.

Therefore, the question is no longer “Will Sumba open?” The real question is: Who will shape the future of Sumba hospitality investment?

FAQs — Sumba Hospitality Investment

Is Sumba good for hospitality investment?

Yes. Sub-150k arrivals, ADRs above US$800–2,000, and airport upgrades create early-mover advantage.

What ROI is realistic?

Build-to-hold yields: 8–15% (IRR 12–18%). Build-to-sell IRRs: 18–25% with land appreciation.

What are the main risks?

Permits, water scarcity, waste, and infrastructure delays. These can be mitigated through structuring.

How does Sumba differ from Bali and Lombok?

Bali = volume. Lombok = mid-market. Sumba = authentic luxury, controlled supply, ESG focus.

How can foreign investors participate?

Via PT PMA with HGB rights. Follow OSS-RBA licensing and environmental approvals.

Call to Action

At Zenith Hospitality Global, we help investors transform opportunities like Sumba into operationally sound, future-proof projects.

From land banking to ROI modeling, ESG integration, and full SOP systems — we ensure your investment is profitable and sustainable.

👉 Contact Zenith Hospitality Global to discuss your Sumba hospitality investment strategy today.