Introduction

Hospitality ROI miscalculations are the hidden reason so many hotels, villas, and resorts collapse before welcoming their first guest. Investors often blow budgets, underestimate pre-opening costs, or over-project rates—only to find themselves firefighting with no reserves left.

This article reveals the most common ROI mistakes, explains why they derail projects, and shows how Zenith Hospitality Global prevents them with stress-tested modelling and integrated design–operations planning.

What are hospitality ROI miscalculations?

Hospitality ROI miscalculations are budgeting and modelling errors that distort an investor’s expected returns.

They include:

- Over-optimistic ADR and occupancy projections

- Underestimated pre-opening costs

- Ignoring taxes, financing, and OTA commissions

- Treating CAPEX as the only budget line

👉 Definition line: Hospitality ROI miscalculations are errors in financial modelling that cause projects to fail before operations begin.

How do hospitality ROI miscalculations sink projects before opening?

Owners often focus on design and construction, assuming they can “fix operations later.” By opening day, however, the damage is already baked in.

Research from McKinsey shows that megaprojects typically suffer 30–80% cost overruns and ~50% schedule delays, a pattern that hotel and villa developments inherit directly.

Why are hotel pre-opening costs so often underestimated?

Pre-opening costs can reach USD 5,000–20,000 per room, yet many models bury them inside CAPEX or skip them entirely.

Hidden expenses include:

- Executive recruitment and relocation

- Training payroll and service rehearsals

- Marketing and PR campaigns

- IT system licenses and setup

- OS&E and initial inventories

- Working capital for 6–9 months

As HVS highlights in its global cost surveys, projects that neglect these costs routinely miss ROI before operations stabilize.

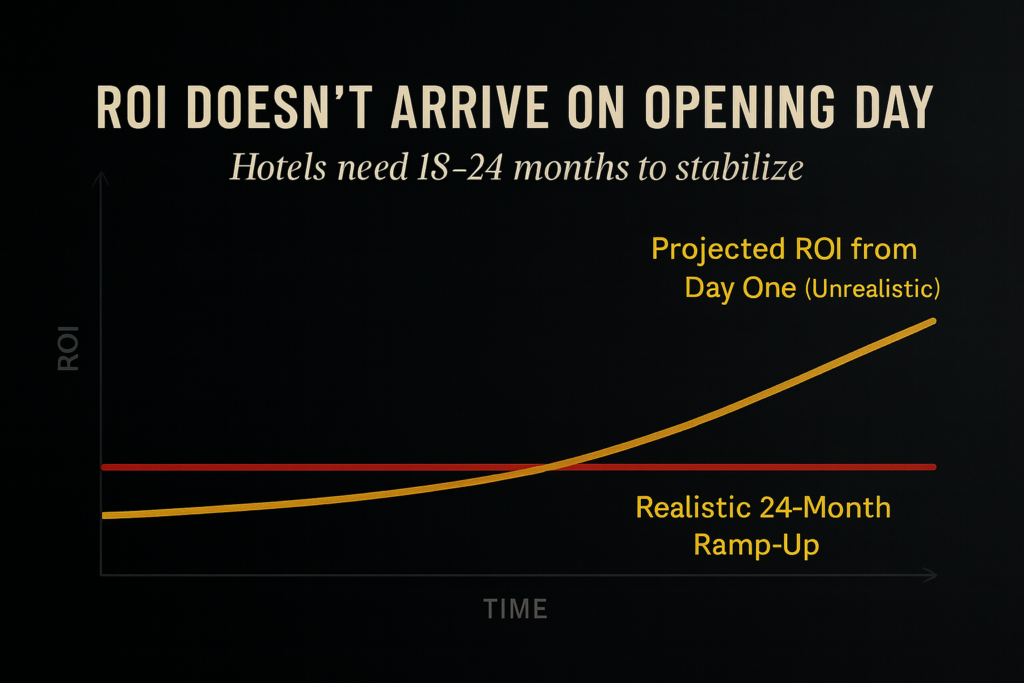

What revenue assumptions are most often flawed?

The biggest pitfall is assuming steady-state RevPAR from month one. In reality, most hotels need 18–24 months to reach market index.

Other common errors include:

- Ignoring OTA commissions (12–18%)

- Over-projecting ADR growth

- Misallocating service charge income

As discussed in our F&B Profit Systems Playbook, unchecked assumptions in one department often cascade across the entire operation.

For deeper market context, STR Global data shows how ramp-up dynamics vary significantly by region, property type, and brand affiliation.

Why is design–operations collaboration critical?

Design without operational input leads to costly redesigns—kitchen flows, laundry, IT risers, and storage often get locked too early.

Zenith builds gate reviews at concept, schematic, and detailed design stages. This avoids late rework and ensures the guest experience is financially and operationally sustainable.

How can Zenith prevent hospitality ROI miscalculations?

Our 9-step ROI protection framework integrates finance and operations:

- Stress-test ADR/Occ with ramp curves

- Model OTA & channel leakage

- Build monthly cost stacks (payroll, utilities, COGS, brand fees)

- Create a dedicated pre-opening schedule + reserves

- Stage CAPEX with escalation factors

- Add financing tabs with IDC & covenants

- Include VAT, service charge pools, levies

- Run Monte Carlo stress testing

- Require Ops sign-offs on design

We applied the same framework in our Bali licensing guide, where regulatory oversight and financial resilience go hand in hand.

Case examples: Failure vs. success

Failure: A Bali villa project launched with no pre-opening budget. Payroll and IT invoices drained reserves in 3 months. Occupancy stuck at 40%. Investors never recovered.

Success: A Lombok resort applied Zenith’s staged CAPEX and ramp modelling. Despite slow ADR growth, it achieved 92% of market RevPAR index by month 24 with positive cash flow.

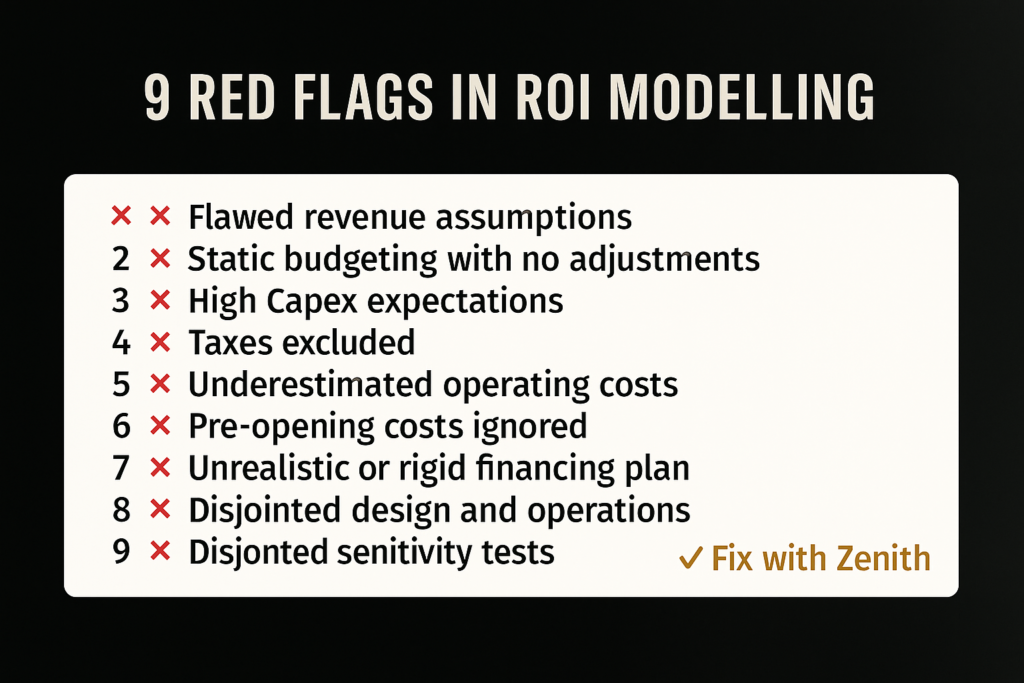

Checklist: 9 red flags in hospitality ROI miscalculations

- Flat RevPAR projection from month one

- Pre-opening buried in CAPEX

- No operating reserve

- CAPEX contingency <10%

- Missing IDC / covenant tests

- Ignored OTA commissions

- Over-credited service charge

- Unrealistic ADR growth curves

- Kitchens/BOH frozen before Ops input

FAQ

Q1: How long until a hotel reaches ROI stability?

Usually 18–24 months.

Q2: What is the average pre-opening cost per room?

USD 5,000–20,000 depending on positioning.

Q3: Can hospitality ROI miscalculations be fixed later?

Rarely. By opening, sunk costs and weak revenue lock in losses.

Q4: How do banks treat flawed ROI models?

They discount IRR if ramp and financing costs are missing.

Q5: How does Zenith protect ROI?

With stress-tested models, staged CAPEX, and design–Ops collaboration.

Conclusion & CTA

Hospitality ROI miscalculations are the silent killer of new hotels and villas. They drain reserves before operations begin and destroy investor confidence.

Zenith Hospitality Global helps investors model reality—not fantasy—by stress-testing revenue, budgeting full pre-opening costs, and aligning design with operations.

Continue learning: