What is Bali’s real-estate bubble?

Bali’s real-estate bubble is the rapid growth of hotels and villas that exceeds sustainable demand.

Oversupply is not only about numbers—it erodes pricing power, strains infrastructure, and damages long-term guest perception. Investors risk pouring millions into projects that fight a losing rate war.

For context, our earlier analysis on Managing Destination Overcrowding in Bali shows how unchecked growth harms both ROI and the island’s reputation.

How does Bali’s real-estate bubble impact ROI?

The danger is clear: oversupply pushes projects into financial stress.

- Average Daily Rate (ADR) compression → forced discounting in crowded markets.

- Occupancy erosion → too many keys chasing the same demand.

- Payback delays → timelines stretch from 7–8 years to over 12.

External analysts agree: Colliers’ Bali report notes volatility in rates and occupancies as new supply enters fragile submarkets.

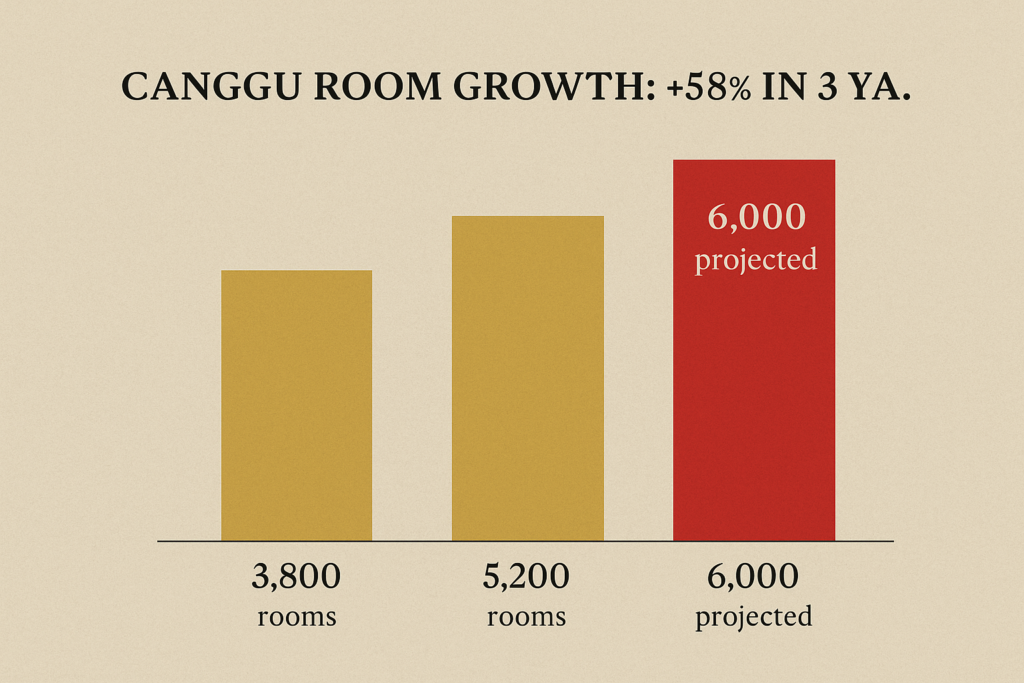

How fast is Canggu room supply growing?

Canggu is the clearest example of Bali hotel oversupply:

- 3,800 rooms → 5,200 rooms in just a few years.

- 6,000 rooms projected in the near term.

This surge already outpaces infrastructure, leading to congestion, weaker guest experience, and shrinking NOI.

What pipeline data reveal about Bali hotel oversupply

The island-wide snapshot:

- Total rooms: ~58,900

- Pipeline: ~5,300 new keys (Horwath HTL / C9 Hotelworks)

- Canggu: ~1,592 rooms under construction

- Ubud: ~844 rooms

- Jimbaran/Uluwatu: ~1,193 rooms

Sources like Horwath HTL’s Bali pipeline report confirm that the heaviest growth is concentrated exactly in saturated nodes such as Canggu and Ubud.

How to stress-test ROI in Bali’s real-estate bubble

Zenith Hospitality Global applies a Bali ROI stress testing framework that protects investors from oversupply.

Inputs we analyze:

- Pipeline delivery dates.

- ADR and occupancy baselines.

- Short-term rental (STR) leakage.

- Permit friction (moratorium, zoning bans).

- Infrastructure capacity.

Scenarios modeled:

- Bear case: ADR −10%, occupancy −5 pts → payback +4 years.

- Base case: Pipeline delays, flat ADR → payback +2 years.

- Bull case: Strong permit enforcement, ADR +3–5%.

For a practical example of framework building, see our article on Lombok Tourism Growth Strategy.

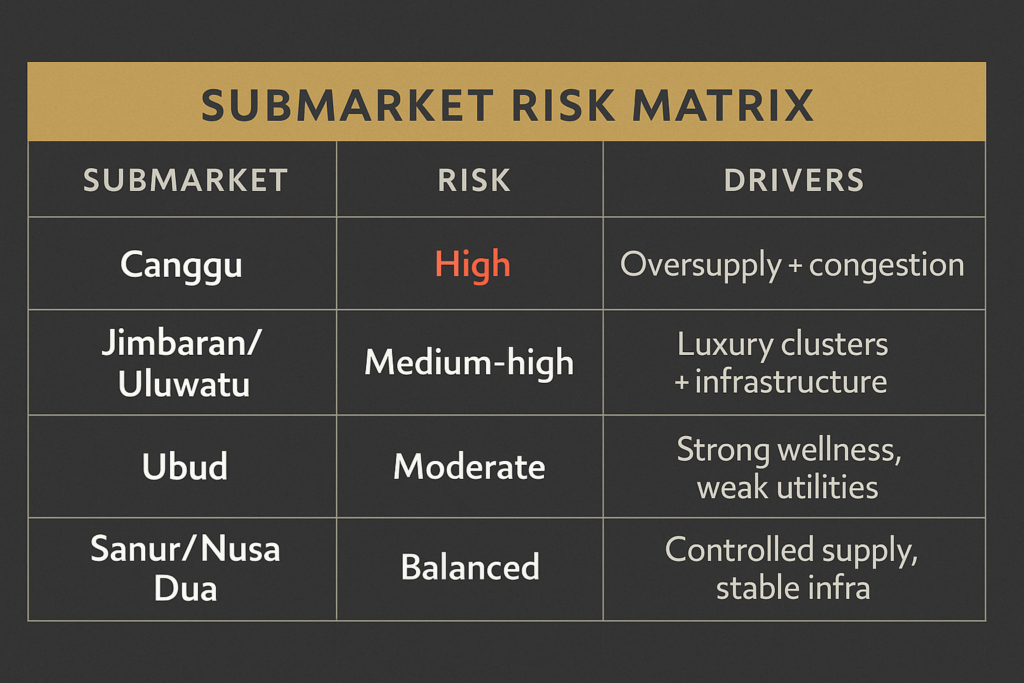

Which Bali submarkets face the highest risk?

- Canggu / Berawa / Pererenan: High risk. Largest pipeline, STR leakage, traffic congestion.

- Jimbaran / Uluwatu: Medium-high risk. Luxury clustered, infrastructure fragile.

- Ubud: Moderate risk. Strong wellness demand, but limited utilities.

- Sanur / Nusa Dua: Balanced. Controlled supply, better infrastructure.

What strategies protect ROI in oversupplied areas?

- Target moated assets – beachfronts, irreplaceable views, or unique anchors.

- Diversify revenue – memberships, destination dining, medical wellness.

- Phase delivery – deploy capital in stages.

- Run feasibility studies – validate ROI before committing.

- Track permits closely – adjust for moratoriums and zoning shifts.

Our playbook on F&B Profit Systems shows how additional revenue channels safeguard investor returns.

FAQ

1. Is Bali’s real-estate bubble real?

Yes. Canggu already shows unsustainable growth in rooms and villas.

2. How does oversupply reduce ROI?

By forcing ADR cuts, lowering occupancy, and extending payback periods.

3. Which areas are most oversupplied?

Canggu, then Jimbaran/Uluwatu.

4. Can permits stop the oversupply?

They help, but enforcement is inconsistent.

5. How does Zenith help investors?

Through feasibility studies, ROI stress testing, and phased capital strategies.

How to stress-test a Bali project in 3 steps (HowTo Schema)

- Map pipeline supply: Count rooms within 3 km.

- Model ADR/occupancy shock: Apply −10% ADR, −5 pts occupancy.

- Check permits: Factor moratorium and zoning delays.

If IRR falls below 12% in this model → phase or pivot.

Conclusion

Bali’s real-estate bubble is no longer hypothetical. Canggu’s leap from 3,800 to 5,200 rooms—soon 6,000—proves that oversupply is here. Without discipline, investors will face rate wars, longer payback, and brand erosion.

Yet opportunities remain. With data-driven feasibility, ROI stress testing, and phased strategies, investors can avoid the bubble and secure long-term returns.

Call to Action

Don’t build into Bali’s bubble.

Zenith Hospitality Global provides feasibility studies, ROI stress testing, and market intelligence that protect your investment.

📖 Read next: Managing Destination Overcrowding in Bali: A Strategic Call to Action