Bali hotel investment comparison: off-plan presale units promise high yields, but real-world performance splits sharply between fragmented unit ownership and professionally managed, integrated hotel businesses. This article gives investors the data and underwriting lens to test claims, model true total cost of ownership, and pressure-test exit logic before buying off-plan in Bali (and comparable Southeast Asian markets).

This Bali hotel investment comparison is written for foreign investors, family offices, and individuals who want decision-grade clarity before committing capital—beyond developer marketing materials.

TL;DR / Key Takeaways

- Presale units are structurally optimized for developer capital formation, not investor durability.

- Headline yields often fail once you model true total cost of ownership and downside occupancy.

- Integrated professional management usually has better tools to defend occupancy, ADR, and RevPAR—especially in competitive corridors.

- Your best protection is a side-by-side underwriting: unit ownership vs managed property shares vs direct hotel ownership.

Bali hotel investment comparison: why presale units look “easy” (and why they break)

The presale model is brilliant at raising development capital quickly and selling a passive-income narrative. Investors see a smaller ticket size, glossy renders, and “guaranteed” or “target” returns that feel comparable to institutional products.

What gets missed is structural: a presale unit is not automatically a hotel investment. It is often a fragmented short-term rental business with hotel-like costs—without hotel-grade governance, standards enforcement, or distribution strategy.

If you want a grounded mental model: in a presale unit, you often own inventory. In a professionally managed integrated asset, you own a business.

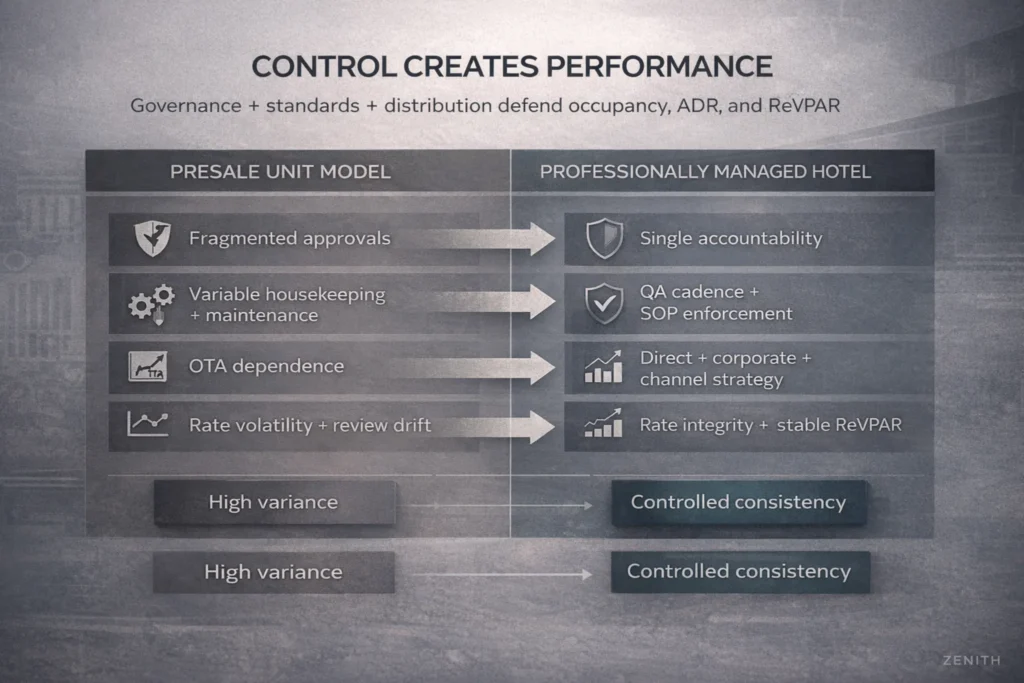

Bali hotel investment comparison: what “professional management” really changes in Bali

Professional management is not a logo or a brochure claim. It is the ability to control the levers that protect RevPAR through cycles:

- Revenue management (rate discipline, segmentation, channel mix, length-of-stay strategy)

- Quality assurance (service variance control, housekeeping standards, preventative maintenance)

- Asset discipline (FF&E reserve funding, refurbishment timing, product standards)

- Distribution strategy (owned channels, direct conversion, corporate/agency relationships)

This is also why we advise investors to understand “operational design” early—because many yield failures start as design failures. If you want a practical reference point, see Zenith’s guide on Operational Hotel Design in Bali.

Bali off-plan hotel investment data: what to verify before trusting “15% yield”

A yield claim is only meaningful if it survives real market performance data and full cost stack math.

External demand context (Bali)

Start with official demand signals, not anecdotes. For international arrivals, use BPS Bali as the baseline source (and then drill down into micro-markets). See BPS Bali tourism tables for official reporting.

Hotel performance benchmark (professional set)

For professional hotel performance benchmarks and credible market reporting, use the Horwath HTL / C9 Hotelworks Bali Hotel & Branded Residences Report as a benchmark reference. Example: Bali Hotel & Branded Residences Report 2025 (PDF).

STR competitive pressure (typical presale unit comp set)

Presale units frequently compete against STR/villa supply. For structured STR analytics, use a data provider rather than marketing commentary. A reference point is Airbtics Bali short-term rental market data.

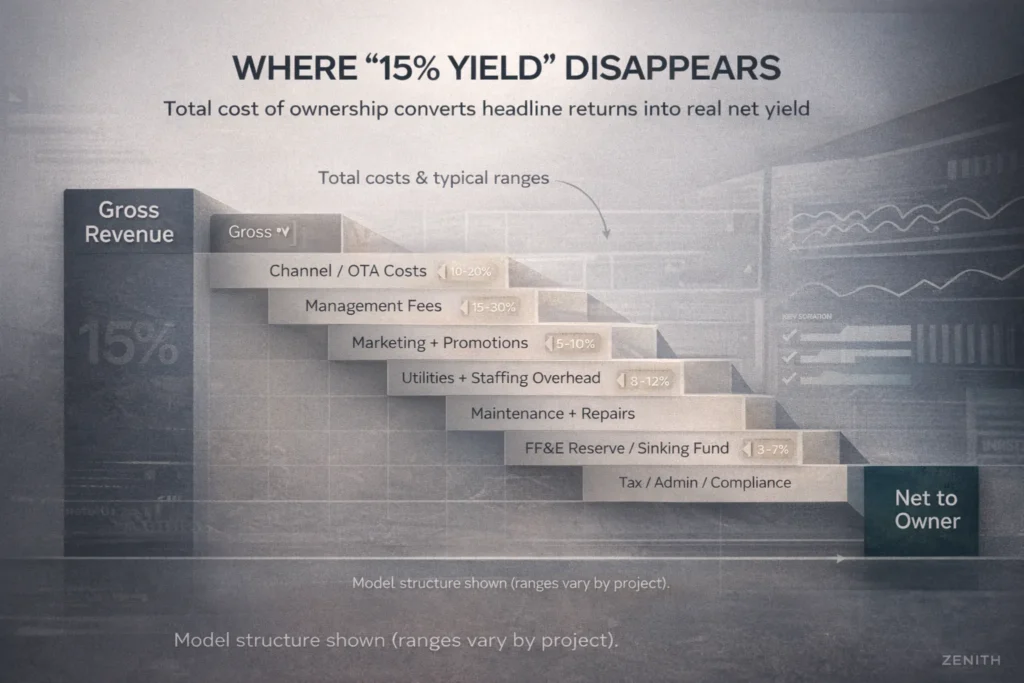

Bali off-plan hotel investment: where “15% yields” evaporate in real underwriting

Most investor disappointment is not caused by one dramatic failure. It is caused by a slow, predictable stack of costs and variance.

The Yield Erosion Stack (typical presale unit reality)

Model these explicitly—do not accept them as “handled by management.”

- OTA commissions / channel costs

- Management fees (base + incentive + pass-through admin)

- Marketing & promotions (launch and ongoing)

- Maintenance & repairs (reactive + preventive)

- FF&E reserve / sinking fund (replacement CAPEX is not optional)

- Utilities, internet, service contracts

- Compliance / admin overhead (especially relevant for foreign reminding structures)

- Ramp-up variance (opening year is rarely stabilized)

The “dangerous gap” is when your investment memo assumes a stabilized P&L, but your asset behaves like a new STR product in a hyper-competitive corridor.

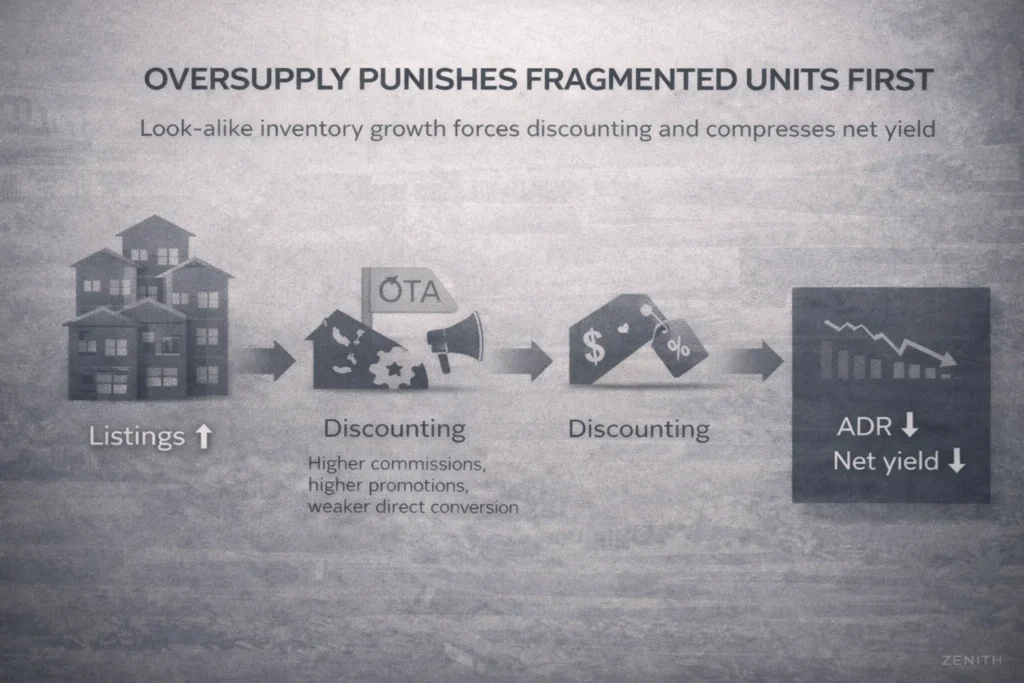

Villa investment vs hotel investment Bali: why oversupply hits units harder

Oversupply is not only “more keys.” It is pricing power erosion plus review variance.

Presale units typically lose on:

- Rate integrity: one operator discounts; the comp set follows.

- Standard drift: housekeeping and maintenance variance pushes ratings down; ADR follows.

- Refurbishment delays: owner disagreements delay reinvestment; the product ages fast.

- Governance friction: approvals take time; asset decisions become political.

- Bali hotel investment comparison: oversupply and ADR compression

If you want the investor lens on oversupply risk in Bali, see Zenith’s analysis: Bali’s Real-Estate Bubble: Oversupply Threatens ROI.

How does this compare across Indonesia and Southeast Asia?

Bali is not unique. The same presale narrative repeats across SEA—especially when “guaranteed returns” are used to replace underwriting.

Vietnam (condotel lesson)

Vietnam’s condotel cycle is a clear cautionary signal: multiple projects promoted high guaranteed returns and later renegotiated or failed to pay. A compact reference is VnExpress’ reporting on the risks of guaranteed returns: Guaranteed returns ploy driving condotel craze—fraught with risk (VnExpress).

Indonesia (structure + compliance pressure)

Indonesia adds additional complexity: foreign structuring, leasehold reality, licensing pathways, and ongoing compliance overhead. If you are building a real hospitality business (not just buying a unit), the earliest “operator-grade” work is aligning design, compliance, and operating logic—see Architect Hospitality Consultant Bali: Design That Opens Right.

A clean Bali hotel investment comparison table: what you own, what you control, what can fail

| Structure | What you truly own | What you control | Where it commonly fails |

|---|---|---|---|

| Presale unit (off-plan) | A single unit / inventory | Low (fragmented governance) | Yield erosion + review variance + illiquidity |

| Shares in a professionally managed property | Participation in a managed business | Medium (via governance + reporting) | Structure quality + manager selection |

| Direct hotel ownership (single governance) | Entire operating business | High | Execution risk (operator, team, governance) |

This is also why we push “concept durability” as an investment variable, not a branding variable. A helpful related read is Timeless Hotel Concept: Build for 20-Year Relevance.

How-To: Underwrite presale units like a professional (7 steps)

Step 1 — Classify the asset: inventory or business?

If you cannot answer who controls pricing, standards, refurbishment, and channel mix, you are not underwriting a hotel business. You are underwriting inventory with hotel-like costs.

Step 2 — Build a real revenue line (range, not fantasy)

Model occupancy and ADR as downside / base / upside, with seasonality and ramp-up.

Step 3 — Apply the full Total Cost of Ownership (TCO)

Include management fees, channel fees, marketing, maintenance, FF&E reserve, utilities, insurance/admin, and vacancy/ramp variance.

Step 4 — Stress-test “downside survivability”

Ask: if occupancy drops 10–15% and ADR compresses, do you still clear your minimum cash yield?

Step 5 — Validate governance terms (not brochure promises)

Check sinking fund rules, refurbishment obligations, owner voting thresholds, reporting transparency, operator termination clauses.

Step 6 — Benchmark against professional alternatives

Run the same model against:

- participation in a professionally managed property, and

- direct hotel ownership with a credible operator plan.

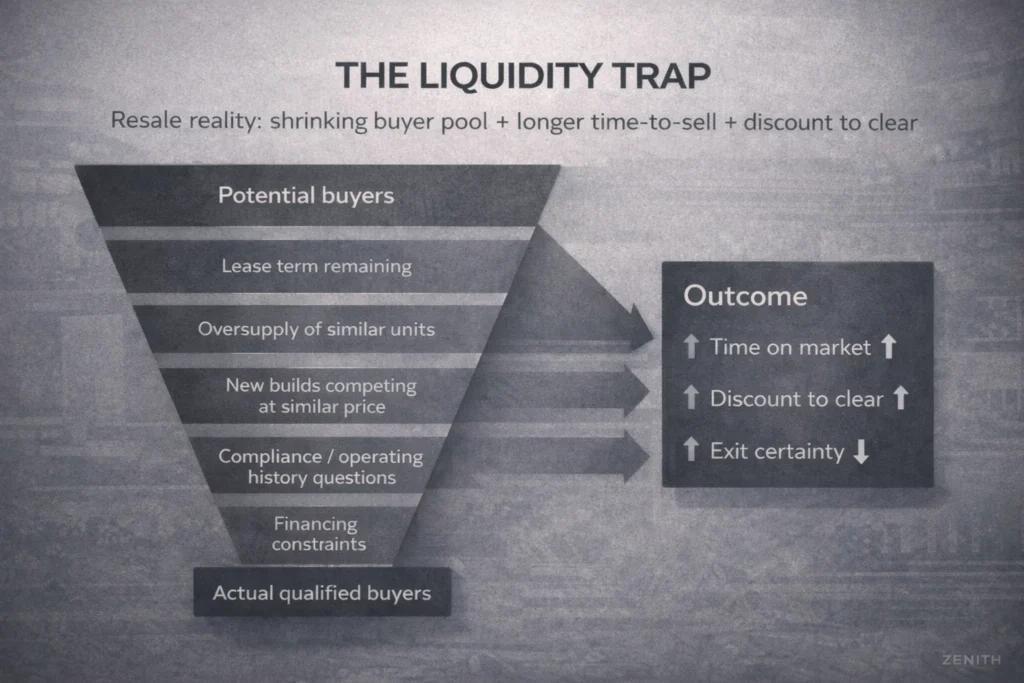

Step 7 — Underwrite exit, not only entry

Who is the buyer in year 3/5/7? What discount applies under oversupply? What is the true liquidity profile?

FAQs

Is a “15% net yield” on a Bali off-plan unit realistic?

It can be, but it is uncommon without exceptional positioning, disciplined management, and conservative assumptions. If the model does not show a full TCO stack, ramp-up variance, and downside survivability, the yield is a marketing number. Use the benchmark data discipline in this Bali hotel investment comparison and test the claim against real RevPAR dynamics.

What is the biggest operational risk in presale unit investments?

Service variance and maintenance variance. When standards are inconsistent, review scores fall, conversion drops, and ADR erodes. Fragmented governance makes it harder to correct quickly. Integrated hotels can enforce standards faster because the asset is governed and operated as one system.

What should a foreign investor in Indonesia compare an off-plan unit against?

At minimum: (1) presale unit ownership, (2) shares/participation in a professionally managed property, and (3) direct hotel ownership with professional operator support. The decision is not only about returns—it is also about governance, compliance, and exit realism.

How do I pressure-test “Bali tourism is booming” as an investment argument?

Start with official data (BPS), then move to the specific micro-market and competitive set. Strong arrivals do not guarantee your unit’s pricing power. Supply growth, channel costs, and product differentiation decide your realized yield.

Summary Takeaways

- Treat every presale unit as a hospitality business unless proven otherwise. Real costs behave like hospitality, not passive real estate.

- Your real risk is not “tourism drops to zero.” Your real risk is rate compression + cost stack + review variance.

- Use official and credible benchmarks: BPS for demand, Horwath HTL/C9 for hotel performance, and disciplined STR analytics for competitive pressure.

- If governance is fragmented, assume slower corrective action and faster standard decay.

- Your best protection is a side-by-side underwriting—this is the core of a decision-grade Bali hotel investment comparison.

Call to Action (Zenith)

If you are evaluating an off-plan unit purchase, Zenith provides unbiased investment structure analysis—presale unit ownership vs professionally managed property participation vs direct hotel ownership. We benchmark performance using credible sources and convert it into a total cost of ownership + downside survivability model so you can commit capital with clarity.

Explore Zenith’s platform here: Zenith Hospitality Global and review our approach and team background here: About Zenith.

Author

André Priebs is CEO of Zenith Hospitality Global—an operator-first advisory and management platform focused on luxury boutique hotels, lifestyle retreats, and wellness/longevity assets across Bali and Southeast Asia. André supports owners and investors with feasibility stress-testing, governance design, operating systems, and commercial performance strategy.